If you are an Indian taxpayer, you must have both a Permanent Account Number (PAN) and an Aadhaar card. However, many taxpayers are not aware of the requirement to link their PAN with Aadhaar. In this article, we will guide you through the process of linking your PAN with Aadhaar.

What is PAN and Aadhaar?

PAN:

A Permanent Account Number (PAN) is a unique 10-digit alphanumeric identifier issued by the Income Tax Department of India. It is used for various financial transactions, such as filing income tax returns, opening a bank account, and investing in financial products.

Aadhaar:

Aadhaar is a 12-digit unique identification number issued by the Unique Identification Authority of India (UIDAI). It contains the biometric and demographic information of an individual and is used for various government schemes and services.

Why Link PAN with Aadhaar?

The government of India has made it mandatory for taxpayers to link their PAN with Aadhaar. This is to curb tax evasion and ensure that taxpayers file their income tax returns on time. Failure to link PAN with Aadhaar can result in the invalidation of your PAN card.

How to Link

PAN with Aadhaar

Online Method

Step 1: Visit the Income Tax Department e-Filing website

Visit the Income Tax Department e-Filing website (https://www.incometax.gov.in) and click on the “Link Aadhaar” option under the Quick Links section.

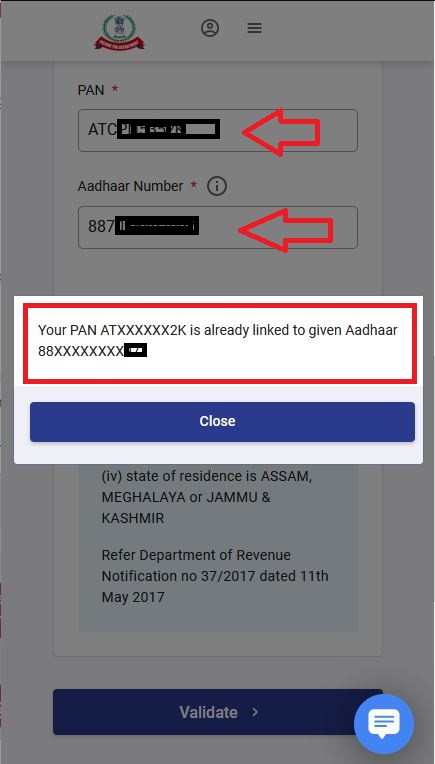

Step 2: Enter PAN, Aadhaar, and other details

Enter your PAN and Aadhaar. Then click on the “Validate” button.

Step 3: Verify Aadhaar details

Your Aadhaar details such as name, date of birth, and gender will be displayed on the screen. Verify the details and click on the “Submit” button.

Step 4: Linking status

After submitting the details, a message will be displayed on the screen showing the linking status. If your Aadhaar is already linked with PAN, a message will be displayed saying “Aadhaar already linked with PAN.”

SMS Method

Step 1: Send an SMS

Send an SMS to 567678 or 56161 from your registered mobile number in the following format: UIDPAN<SPACE><12 digit Aadhaar number><SPACE><10 digit PAN number>

Step 2: Verification

After sending the SMS, a verification process will be initiated, and your PAN will be linked with Aadhaar.

Conclusion

Linking your PAN with Aadhaar is a simple process that can be done online or via SMS. It is mandatory for taxpayers to link their PAN with Aadhaar, and failure to do so can result in the invalidation of your PAN card.

Frequently Asked Questions

What is the deadline to link PAN with Aadhaar?

The deadline to link PAN with Aadhaar is 31st March 2023.

Is it necessary to link PAN with Aadhaar?

Yes, it is mandatory for taxpayers to link their PAN with Aadhaar.

Can I link multiple PANs with one Aadhaar?

No, you cannot link multiple PANs with one Aadhaar.

What happens if I fail to link my PAN with Aadhaar?

If you fail to link your PAN with Aadhaar, your PAN card will become invalid.

How can I check the linking status of my PAN with Aadhaar?

You can check the linking status of your PAN with Aadhaar on the Income Tax Department e-Filing website. Simply click on the “Link Aadhaar” option and enter your PAN and Aadhaar details. The website will display the linking status.